The Value Perspective

This page aims to inform investors about "Value investing", the art of buying stocks which trade at a significant discount to their intrinsic value.What is value investing?

This page aims to inform investors about ‘value investing’, the art of buying stocks which trade at a significant discount to their intrinsic value. We explain, in regular blog posts, how we follow this discipline, scouring the market for irrationally unloved stocks and patiently waiting for a correction in the price.

The Value Investment team

We are a team of eight investment professionals who work together on the equities desk in the Value Investment team at Schroders.

Our consistent and systemic value investing strategy is guided by two key processes:

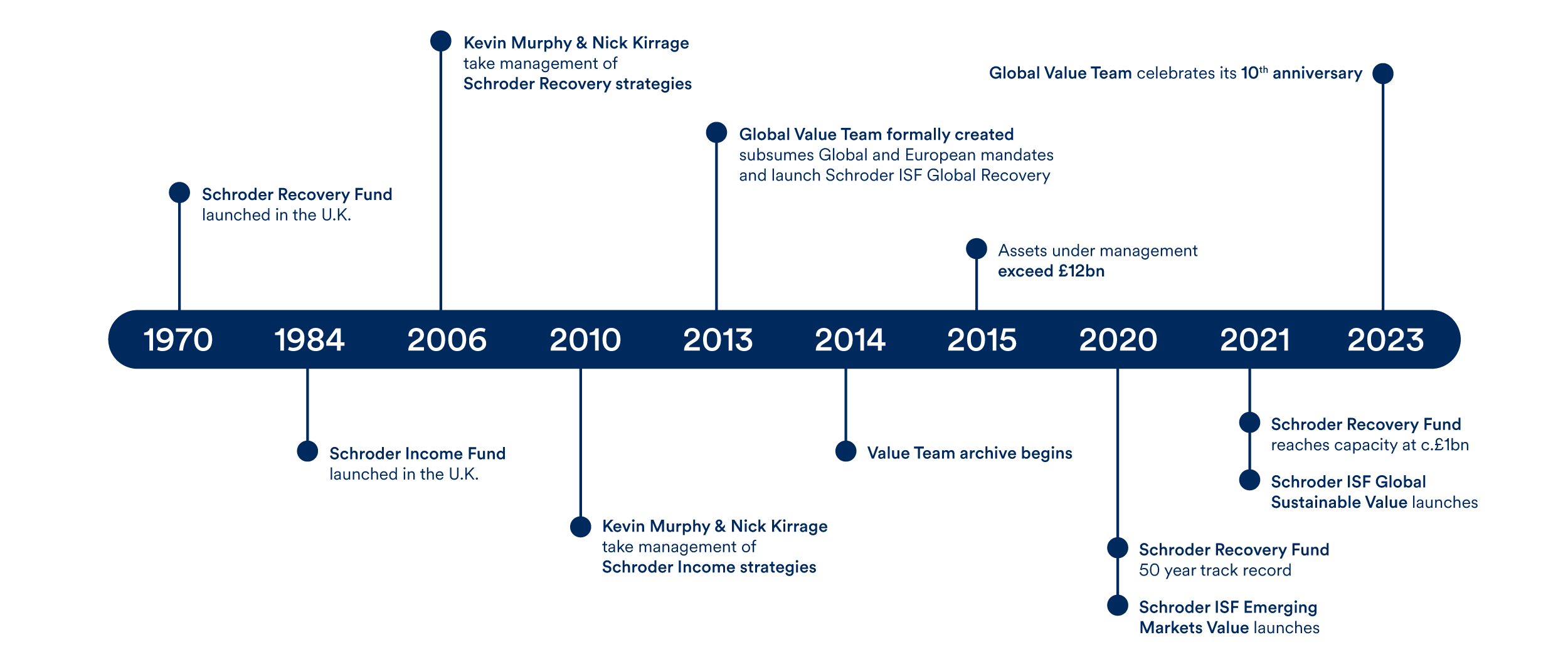

The Value Team timeline